REVENUE RECOGNITION

For 2019, there is a new accounting rule for revenue recognition that applies to non-public companies. In addition, there are other accounting rules for coming years. It is important to know these changes as they will change your accounting and financials and will help in Tax preparation services. Most banks, lenders, and investors want to see Generally Accepted Accounting Principles (GAAP) financial statements. Having GAAP financial statements allows a reader to use standard GAAP reporting to understand your financial statements, apply financial ratios and compare to industry ratios. Be prepared and contact us if we can assist.

Background

In May 2014, the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) issued substantially converged final standards on revenue recognition. These final standards were the culmination of a joint project between the Boards that spanned many years. The FASB’s Accounting Standards Update (ASU) 2014-09, Revenue from Contracts with Customers (Topic 606), provides a robust framework for addressing revenue recognition issues, and upon its effective date, replaces almost all pre-existing revenue recognition guidance in current U.S. generally accepted accounting principles (GAAP). Implementation of the robust framework provided by ASU 2014-09 should result in improved comparability of revenue recognition practices across entities, industries, jurisdictions and capital markets. The effective dates for the new guidance are staggered. Public entities have already implemented the new guidance, and nonpublic entities are required to implement the new guidance in their first annual reporting period beginning after December 15, 2018.

Scope

All customer contracts fall within the scope of ASC 606 except those for which other guidance is provided in the ASC (e.g., leases, insurance contracts, financial instruments, guarantees, non-monetary exchanges).

Core principle and key steps

Revenue is now recognized in a five-step process:

- Identify the contract with the customer

- Identify the performance obligations in the contract

- Determine the transaction price

- Allocate the transaction price to the performance obligations

- Recognize revenue when (or as) each performance obligation us satisfied.

LEASES

Starting in 2021, there is a new accounting rule for leases that applies to non-public companies. Early adoption is allowed and recommended. Although this new standard doesn’t need to be implemented for private companies until 2021, we are recommending applying it for 2020, so the company will have comparable financial statements for 2021. We feel this law is mean to get the lease liability on the balance sheet. For income taxes, a different method will probably apply.

Background

In February 2016, the FASB issued Accounting Standards Update No. 2016-02, Leases (Topic 842). The new standard requires that all leases should result in an asset and corresponding liability be recognized on the balance sheet. This asset reflects the right to use an asset that is owned by someone else. A corresponding liability reflecting future lease payments is also recognized on the balance sheet.

Scope

All leases with a lease term of over 12 months

Core principle and key steps

- Capital leases are now called finance leases and the reporting of these types of leases did not significantly change.

- Operating leases are now shown on the balance sheet as a liability and a right to use asset for the present value of the future lease payments.

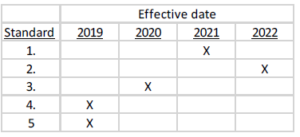

OTHER NEW PRONOUNCEMENTS

- Accounting Standards Update No. 2018-17- Private Company Council (PCC) recommended change to simplify the variable interest entity rules for non-public companies- real estate leased to a related party does not have to be combined now under certain circumstances. Early adoption is permitted. A variable interest entity is a related party entity that cannot stand on its own without a significant financial interest from the related entity.

- Accounting Standards Update No. 2017-04-Simplifying the Test for Goodwill Impairment – Step 2 of the goodwill impairment test was eliminated in order to simplify the test for accounting. Early adoption is permitted. Since 2015, private companies have been allowed the option to amortize goodwill over 10 years, but, if the impairment test is still in place, rather than amortization, then step 2 of the impairment process has been eliminated. Step 2 included determining the implied fair value of goodwill and comparing it with the carrying amount of that goodwill.

- Accounting Standards Update No. 2018-07-Non-employee stock-based compensation – Simplifies, updates and aligns non-employee stock-based compensation with employee accounting.

- Accounting Standards Update No. 2016-15 Cash flow classification –. Aims to eliminate the diversity in practice related to the classification of certain cash receipts and payments.

- Accounting Standards Update No. 2016-18 Restricted cash – Eliminates diversity in the classification of restricted cash on the balance sheet and classification and presentation of changes in restricted cash on the cash flows statement.

The table below shows the effective dates for these other new pronouncements:

Summary:

In summary, we are providing you with some information about some new accounting changes. Other changes may be required, so please contact us to discuss the application of these accounting changes and to review your financial statements if we are not already. This memo is meant to provide you with information on accounting changes, we are not providing accounting advice.