The Setting Every Community Up for Retirement Enhancement (SECURE) Act is the first significant retirement-related legislation in more than a dozen years. It brings many changes that affect employers of all sizes, including some that could be particularly beneficial for smaller employers that sponsor retirement plans. Some of the changes, however, may increase the burden on employers. Here are some of the most important developments for employers, many of which took effect for plan years beginning after December 31, 2019. Please read and see how it can help you design tax strategies for this year

Greater access to multiple employer plans

Multiple employer plans (MEPs) allow small and midsize unrelated businesses to team up to provide their employees a defined contribution plan, such as a 401(k) or SIMPLE IRA plan. By pooling plan participants and assets in one large plan, rather than several separate plans, it’s possible for small businesses to give their workers access to the same low-cost plans offered by large employers. Employers enjoy reduced fiduciary duties and administrative burdens by using outside administrators to manage the plan.

Currently, MEPs generally are limited to participating employers that share some commonality — for example, being in the same industry or geographic location or using the same professional employer organization. The SECURE Act creates a new type of “open MEP” that covers employees of employers with no relationship other than their joint participation in the MEP. These pooled employer plans (PEPs) will be administered by a pooled plan provider (PPP), such as a financial services company. The PPP also will be the named fiduciary of the plan, but each employer is responsible for choosing and monitoring the PPP.

PEPs will be permitted for plan years starting in 2021 or later. The U.S. Department of Labor and the IRS are expected to provide guidance before then, as PEPs generally are subject to the same Employee Retirement Income Security Act (ERISA) and Internal Revenue Code rules as single-employer plans.

In addition, the SECURE Act eliminates the so-called “one bad apple” rule that deterred some employers from taking advantage of MEPs. Under the rule, a regulatory violation by one employer participant (such as failing to make contributions to the plan on schedule) could jeopardize the MEP’s tax-qualified status. The SECURE Act lays out certain requirements that a PEP can satisfy to protect its status in such a situation.

The SECURE Act also provides an alternative to MEPs for small employers seeking the economies of scale they provide regarding administration. It allows a group of plans with a common plan administrator to file a consolidated Form 5500 annual report, with a single audit report, if certain conditions are met.

Looser notice and amendment rules on safe harbor plans

As of January 1, 2020, plan sponsors no longer are required to give notice to plan participants before the beginning of the plan year when the sponsor is making qualified nonelective contributions — that is, contributions an employer makes regardless of whether an employee contributes — of at least 3% to all eligible participants. The requirement to provide advance notice when making safe harbor matching contributions continues.

Plan sponsors also can amend 401(k) plans that don’t use a matching contribution safe harbor to include a 3% nonelective contribution safe harbor any time before the 30th day before the end of the plan year. The amendment can be made later than that only if it provides for a qualified nonelective contribution of at least 4% of compensation, rather than 3%, and the amendment is done no later than the close of the following plan year.

Annuity options

Annuities can help reduce the risk that retirees will run out of money before the last years of their lives, when health care expenses can run high. But many employers have been reluctant to offer annuities for fear of facing lawsuits alleging breach of fiduciary duty if the annuity providers they selected run into financial problems down the road. The SECURE Act preempts this hurdle by immunizing employers from liability if they choose a provider that meets certain requirements, starting December 20, 2019.

The SECURE Act, however, also requires employers to include a lifetime income disclosure on a plan participant’s benefit statements at least annually. The disclosure will show the estimated monthly payments the participant would receive if the total account balance were used to purchase an annuity for the participant and his or her surviving spouse. Before employers can implement this requirement, the U.S. Department of Labor must issue applicable guidance.

Participation by part-time employees

Employers generally have been allowed to exclude employees who work fewer than 1,000 hours per year from defined contribution plans, including 401(k) plans. Starting in 2021, the SECURE Act generally expands the rule by requiring employers to allow not just those who work at least 1,000 hours in one year (about 20 hours per week) to participate, but also those who work at least 500 hours in three consecutive years and are at least age 21 at the end of the three-year period.

Employer contributions aren’t a requirement of the new participation rules for part-time employees. And employers can exclude the latter category of part-time employees from testing under the nondiscrimination and coverage rules, as well as from the application of the top-heavy rules.

Expanded tax credits

The SECURE Act establishes a new tax credit of up to $500 per year to offset start-up costs for new 401(k) and SIMPLE IRA plans with an eligible automatic contribution arrangement (EACA), beginning in 2020. This credit is on top of the plan start-up credit already available and is available for three years. It’s also available to employers that convert an existing plan to one with an EACA.

The new law also boosts the amount of the credit available for small employer pension plan start-up costs. (A “small employer” is one with no more than 100 employees.) The new law changes the calculation of the flat dollar amount limit on the credit to the greater of 1) $500 or 2) the lesser of:

- $250 multiplied by the number of non-highly compensated employees who are eligible to participate in the plan, or

- $5,000.

Like the automatic enrollment tax credit, it’s available beginning in 2020 and applies for up to three years.

Higher automatic enrollment safe harbor cap

Even before the SECURE Act, employers could automatically enroll employees in a 401(k) plan under a safe harbor with a qualified automatic contribution arrangement (QACA). However, elective deferrals for QACAs have been limited to 10% of compensation.

The SECURE Act increases the maximum amount of an employee’s compensation that can be automatically deferred after the employee’s first plan year, from 10% to 15%. (The cap for the first year in the plan is 10%.) The increase is effective for plan years beginning after December 31, 2019.

Adoption deadlines

Previously, many types of retirement plans were required to be set up during the tax year for which they were to take effect. The SECURE Act extends the adoption deadline for a tax year to the due date of the employer’s tax return (including extensions), providing more flexibility to make contributions and reduce tax liabilities.

Costlier penalties

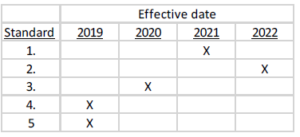

The SECURE Act increases the penalties for failing to file retirement plan tax returns, as follows:

- The penalty for failing to file a Form 5500 is $250 per day, not to exceed $150,000 (up from $25 per day, with a maximum of $15,000).

- The penalty for failing to file a registration statement (IRS Form 8955-SSA) is $10 per participant per day, not to exceed $50,000 (up from $1 per participant per day, with a maximum of $5,000).

- The penalty for failure to provide a notification of change of certain information (for example, the plan name, sponsor or administrator) is $10 per day, not to exceed $10,000 (up from $1 per day, with a maximum of $1,000).

- The penalty for failing to provide a required withholding notice is $100 for each failure, not to exceed $50,000 for all failures during any calendar year (up from $10 for each failure, with a maximum of $5,000).

The penalty hikes apply for filings, registrations and notifications required after December 31, 2019.

Promising, but complicated

These and other changes in the SECURE Act are intended to make it easier and less expensive for employers to offer retirement plans to their employees. (The law also contains a number of significant changes for individuals.) The applicable laws and regulations can prove tricky to navigate. Please contact us with any questions regarding the SECURE Act.

© 2020